Update: There have been ALOT of changes in the Miles & Points world since I originally published this blog post. For an overview of what kind of Pointer I’ve become in 2015 please check out the update to this article here.

Wikipedia has this to say about a Pointer:

1. Anything that points or is used for pointing.

2. A needle-like component of a timepiece or measuring device that indicates the time or the current reading of the device.

3. A breed of hunting dog.

4. (programming) A variable that holds the address of a memory location where a value can be stored.

5. (computing) An icon that indicates the position of the mouse; a cursor.

6. A tip, a bit of advice (usually plural.) The instructor gave me some pointers on writing a good paper.

7. Something worth a given number of points. a ten-pointer

To this definition I’d like to add:

8. A traveller who expresses a passion for the collection and redemption of loyalty award points; Pointing – process of collecting and redeeming loyalty award points.

Yes, I’m definitely a #8. I’m a Pointer. I’ve used airline and hotel reward points many times to not only get from Point A to Point B but also to enjoy travel experiences I would never otherwise have been able to afford. Yes, points have allowed me to attain my travel goals. Yet, it may seem to others that I’ve been a bit obsessive in my pursuit of points. Rest assured my friends, there has always been a method to my madness.

Any discussion of points accumulation and the associated strategies for attaining those points needs to start with a close examination of one’s own personal motivations. All of your efforts should really begin with a round of introspection and the asking of the question: Why?

I’ve found that the asking of the “Why” question helps the budding Pointer figure out not only the best ways to accumulate points but also the most effective ways to spend those points. Moreover, the spending of points should go beyond what’s most “efficient” and should also factor in what would be the most valuable to you from a personal, professional and / or experiential perspective.

With these thoughts in mind, I think it’s important to ask yourself the following questions to help guide your Pointing strategies. These are all questions that I have asked myself and they’ve proved very useful to me as I plot out strategy. As you work your way through this questionnaire, I’ve provided my own answers so that you can start to get a sense for who I am and the thought process behind my Pointing strategies:

Why do you want to collect points?

I know that’s a ridiculously simple question. However, unless you answer it you won’t have a starting point. For example, should you be working towards an airline or a hotel reward or a combination of the two?

My focus is on airline points with my secondary goal being the accumulation of hotel points.

What kind of travel experience are you seeking?

Some people are just looking to get from Point A to Point B and traveling in economy is just fine. Others are saving up for a Trip of a Lifetime. The answer to this question will determine just how many points you will need. That number in turn will give you a sense for how much time you will need to accumulate those points.

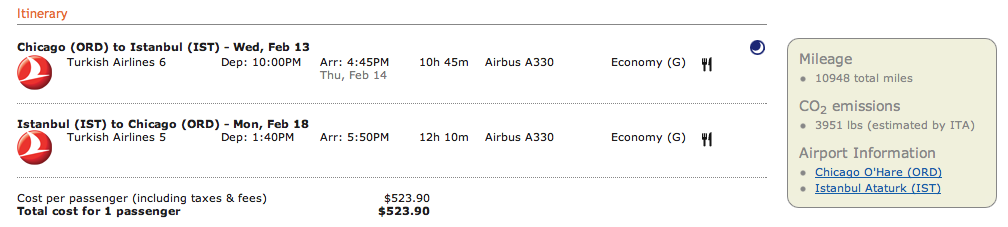

I would fall into the aspirational award category. I’m currently saving up for a “Dream” Anniversary Trip to Thailand in 2015 for my Partner F and I. Of course that sounds a LONG way off. However, I’m hoping to earn enough points to fly to Asia in First Class on Thai Airways’ new A380 or perhaps stretch out in Asiana’s new First Class Suites. In addition, once I get there I’m hoping stay at the Conrad Koh Samui and a few other luxury hotels along the way.

That said, this trip will cost me at least 280,000 United Mileage Plus miles and 200,000 Hilton HHonors points for a 4 night stay on Koh Samui. How am I going to earn all of those points? I’ll tell you how I plan to do this (and shave a few points off the points requirements) in future posts in my blog.

How much do you travel now?

Are you a Road Warrior who travels significantly for business? Are you the occasional leisure traveler? Have you never left your hometown? Travel provides the opportunity to earn the “currency” of award travel, the loyalty reward point. Your current travel patterns will determine how much of this currency you have to reach your Pointing goals.

I don’t travel at all for business. However, I do take 4-5 leisure trips a year which provides me with about 15,000 Mileage Plus miles annually. Given my travel patterns, flying alone will not allow me to reach my Pointing goals in the timeframe of when I would like to take my trip. I’ll need another way to earn those reward miles.

Where do you live?

The answer to this question helps determine who might be the best travel partners for you. For example, do you live near one of the Major Airline Hubs? For example, someone from Minneapolis, Detroit or Atlanta might best be served by aligning with Delta. Someone out of Dallas might best be served by American Airlines.

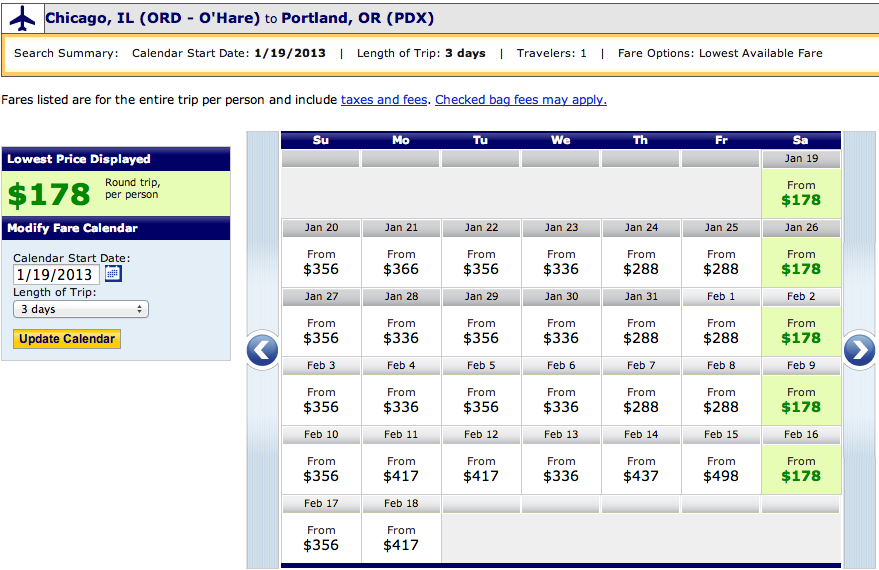

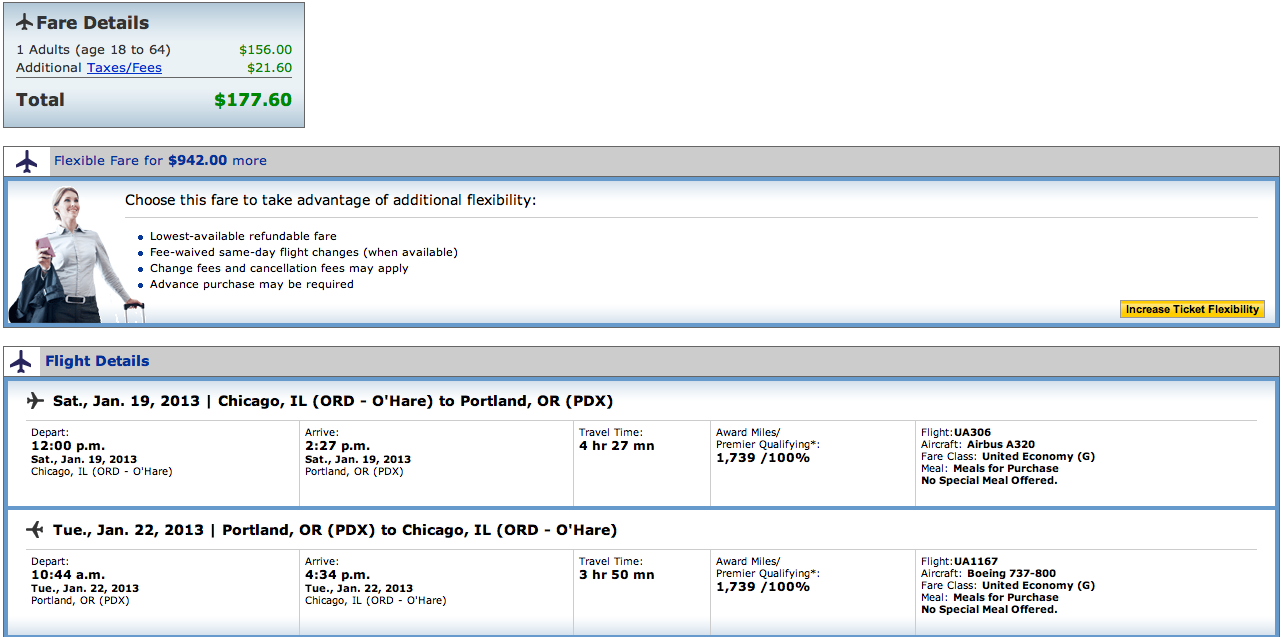

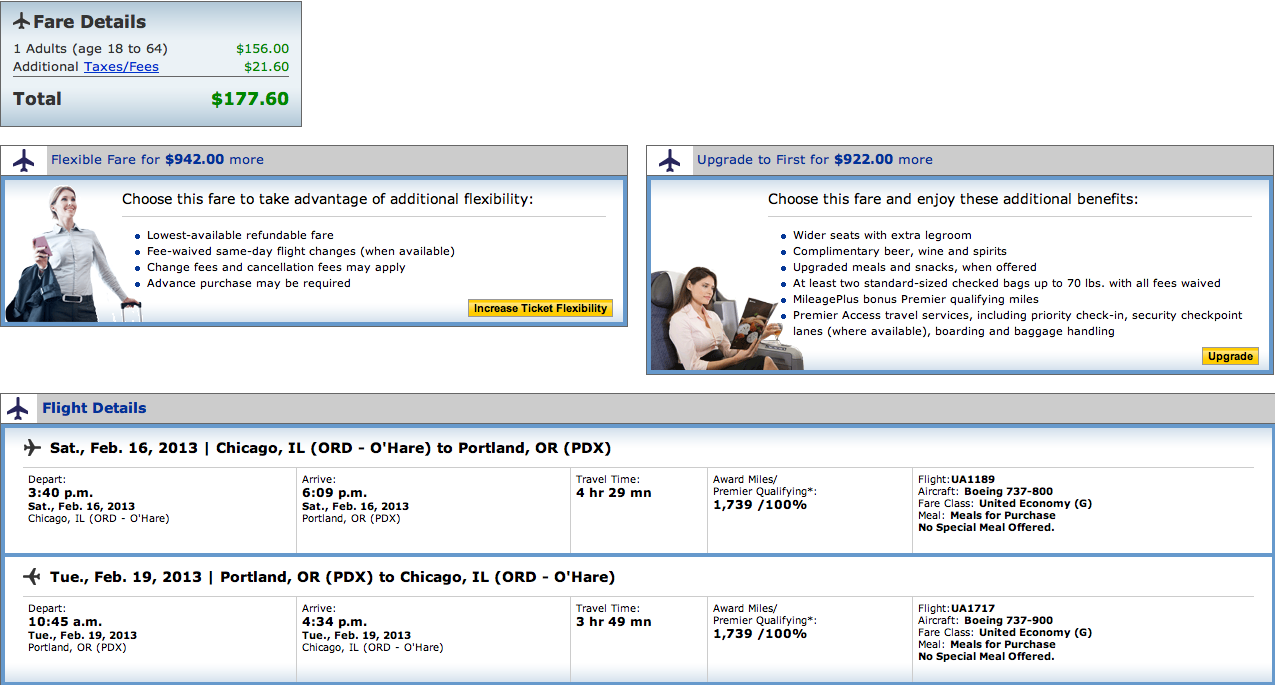

I’m a Chicago guy who benefits from living near O’Hare so I have a great deal of choice with all the major carriers flying into my city. In my case, I’ve aligned with my hometown airline of United. Of course I do have frequent flyer accounts with all the major airlines and will fly American from time to time. However, by declaring a “home” airline I’ll be able to focus my more limited time, travel and financial resources. Of course, I’m never averse to opportunistic Pointing opportunities on other airlines as they arise. All those points add up after awhile!

What’s in your wallet?

Credit cards have changed the landscape of the travel reward industry. Period. These will prove to be a major tool in the Pointing strategies for most people.

Given that I won’t be relying heavily on time in the air to generate points, I will need to rely heavily on credit cards to earn the points I will need to travel. The cards I am currently using include a legacy Chase Select Visa, United Club Card and my new all-time favorite, the Chase Sapphire Preferred card. There are also other specialty cards that I’ve found to be very useful for specific purposes. I’ll go into more details on the benefits of these cards and how I’m using them in future posts. However, the most important concept associated with using “credit card spend” to achieve your Pointing goals is this: NEVER carry a balance and ALWAYS pay your bills off in full every month!

What kind of Pointer am I?

Well from my answers to these questions you can see that a Profile of me has emerged. I’m a non-Road Warrior who will be responsible for funding my own travel. I’ll rely primarily on loyalty points earned from credit card spending. Since I live in Chicago, as a matter of personal preference I will by relying heavily on United Airlines. These characteristics are going to influence the subject matter that I will cover in this blog. In addition, I’m all about the “aspirational” trip. However, getting there I realize will involve spending alot of time at the back of the plane. That said, I’ll also share with you how I’ve managed to take a bit of the sting out of “non-elite” travel.

The wealth of information available is simply staggering. I’ll take the approach of relaying to you what I’ve learned as it applies to my own situation. I plan to personalize the whole Pointing process and give you concrete examples. In some cases, I’ve not done things in the most efficient way and I’ll be ready to share those examples with you so that you can learn from my mistakes. I’m hoping to make Pointing a much more accessible and understandable endeavor. This blog will likely be best suited to the budding Pointer who is trying to sift through a lot of information and is trying to make sense of it all.

I won’t try to be all things to all people. In addition, there will be times where you will be learning things right alongside me. However, I feel I’ve learned a lot over the last several years and would be happy to share it with all of you as I do.

Oh yes, I guess I should also add a #9 to the definitions that started out this post:

9) Pointing / Pointer – a quick shorthand and misuse of the English language that will enable me to more quickly and concisely express the process of collecting and redeeming loyalty award points. I’m not trying to be clever. I’m just too lazy use a thesaurus for coming up with new ways to express this same concept.

With that, let’s get this blog started … and please, be gentle with me …