It was a bit of a roller coaster ride yesterday morning in the Pointing world. The miles and points collecting blogosphere lit up when Ben at One Mile at a Time first reported (see this post) that the American Airlines AAdvantage program would start imposing fuel surcharges on all international award redemptions. Such a move would mean that additional fees of a few hundred to a thousand dollars or more would be added to the cost of redeeming your miles. Gary at View from the Wing provides more detail on fuel surcharges in this post. A few hours later, everyone breathed a huge sigh of relief when American announced that it was all a “mistake” as Ben later outlined here. If this change had actually occurred, the effect would have been a quite substantial devaluation of the AAdvantage mileage program.

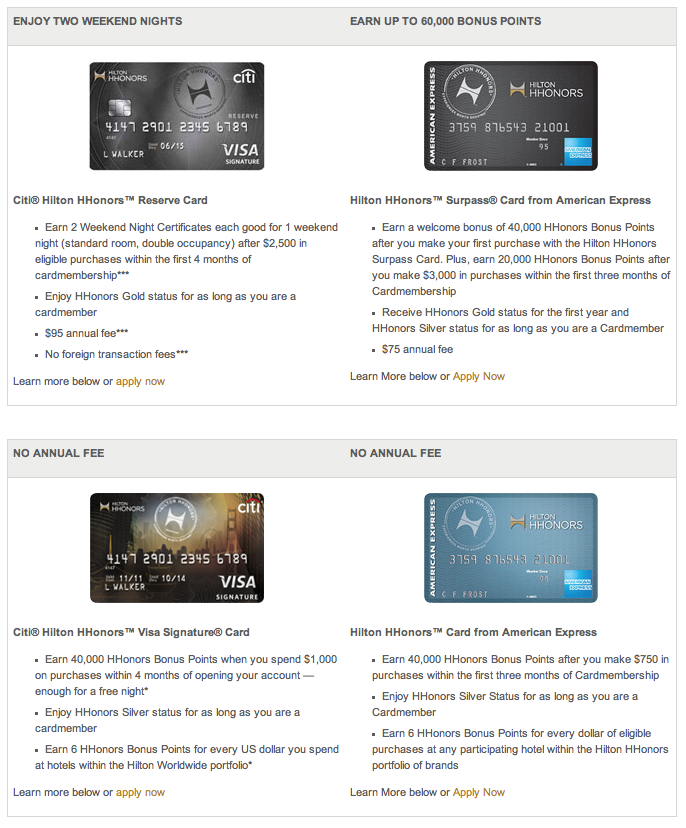

Although we may have dodged a bullet that morning, it’s important to remember that devaluations of reward loyalty programs have occurred in the past and WILL occur again in the future. For example, in one of my earlier blog entries I discussed how I was all Hot for Hilton and how the HHonors program would be a cornerstone of my Pointing activities. That plan all changed on March 28 when Hilton announced a MAJOR devaluation of its loyalty program as outlined here by The Points Guy. All of sudden my aspirational award goal of a stay at the Conrad Koh Samui went from 50,000 points a night to as much as 95,000 points per night. Of course, I’ve experienced devaluations before. Early on in my Pointing I remember redeeming only 90,000 miles for a roundtrip business class flight to Sydney. Today, that same trip would costs 135,000 miles.

There are a couple of lessons to be learned from what happened yesterday. First of all, it pays to DIVERSIFY. As I discussed in my post Feeding the Points Kitty, diversifying your Pointing sources can help you achieve a variety of award goals. However, the added benefit is that if a major devaluation occurs then you won’t end up with “all your eggs in one basket.”

More importantly, you should always remember that your miles and points are meant to be USED. A program devaluation can happen at any time. Although it may take a few years to save for the amount you need to redeem a “dream award” you shouldn’t accumulate huge balances with the intent of using your points “in retirement” since it’s inevitable that your stash will decline in value over time. I tend to redeem for “big awards” every two or three years. My diversification strategy also means that as I deplete one account I usually have another one waiting in the wings for my next redemption.

That said, it certainly was a real nail biter for me yesterday morning. You see, I just signed up for one of the Citi AAdvantage credit cards with a 50,000 mile bonus. Once I hit my spend requirement I’ll have more than enough miles to redeem for 2 First Class tickets to Hong Kong on Cathay Pacific which is part of the Oneworld alliance along with American Airlines. Yes, my plans for my next “Big Trip” are well underway. Devaluations may come and go … but the Pointing always goes on …